Risks to tenants as buy-to-let lending is projected to decline

getty images

getty imagesThe projected decline in lending to homeowners could reduce the number of homes available for rent next year.

UK Finance, the mortgage lenders’ trade body, said the outlook for the buy-to-let sector in 2025 was “challenging” due to landlords facing additional taxes.

This is despite forecasts that interest rates, and in turn, mortgage rates, are expected to decline during the year.

Tenants have faced intense pressure in recent years due to rising rents and competition for available properties.

Forecast for 2025

The buy-to-let sector has seen a “modest recovery” this year after a tough 2023 due to falling mortgage rates in the second half of the year, according to UK Finance.

But, in this Latest Annual Forecastsaid this Additional stamp duty on purchase of additional housesAlso current regulation and taxes will reduce activity.

It predicts a 7% decline in mortgage lending for buy-to-let purchases in 2025 compared to this year.

The National Residential Landlords Association (NRLA) has said that 31% of landlords are planning to sell rented properties in the next two years due to additional cost pressures.

Property portal Zoopla said the average rental cost is now £1,270 a month, up from £270 per month more expensive Than the end of the coronavirus pandemic.

Generation Rent, which lobbies on behalf of tenants, said tenants facing cost-of-living pressures should be given more breathing room.

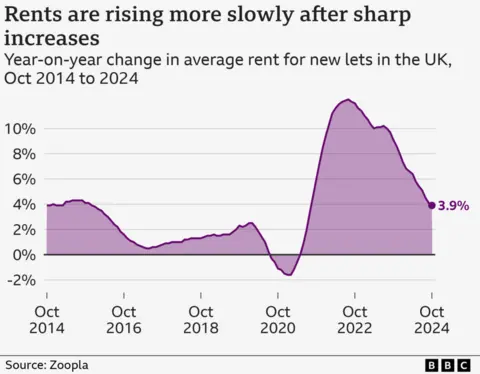

However, the pace of rent increases has slowed as many have reached affordability limits.

Options for first time buyers

When people looking to buy a first home are stuck renting, they may be given some hope in the latest forecasts.

Falling mortgage rates and rising wages improved affordability for homebuyers later this year and UK Finance expects this to continue through 2025.

It has forecast a 10% increase in mortgage lending for home purchases next year, although some analysts have already questioned this prediction as optimistic for lenders.

The latest data shows the average rate on a two-year fixed rate mortgage is 5.47%, according to financial information service MoneyFacts. A typical rate on a five-year deal is 5.25%.

The UK’s largest building society, The Nationwide, said change in stamp duty The first half of 2025 could lead to a volatile housing market for many buyers in England and Northern Ireland.

In addition, UK Finance said it expects many people will find it difficult to move or buy a new home again in 2026.

How to Secure a Rental Property

Agents say there are some simple ways to make it easier to secure a rental property:

- Start searching and sign up with multiple agents before the tenancy ends

- Have salary slips, job reference and reference from previous landlord handy

- Build relationships with agents in the area but be prepared to broaden your search

- Be sure of your budget and calculate how much advance you can offer

- Keep in mind that some agents preview properties on social media before listing them.

There are more tips Here and assistance with your rental rights Here,