No need for ‘big’ council tax rises – Robison

pa media

pa mediaFinance Secretary Shona Robison has claimed council tax rises should be kept to a “minimum” next year.

their government is Local authorities plan to end charge cap From April.

Robison said the proposed £1 billion increase in funding for councils should prevent them from introducing any “large” tax increases.

Before the budget, Council body Kosla warned That increase may be needed to protect “critical services.”

Council leaders are yet to issue a full response to the government’s spending plans, due to meet on Friday.

‘Sensitive results’

Council tax is set, administered and spent by local authorities. The government has previously offered them financial incentives to comply with a limit or cap.

Robison said BBC Radio’s Good Morning Scotland Programme: “I think the deal we’re giving local governments will mean they won’t have to make big increases in council tax.”

He added: “I don’t think there is any administration of any political color that would want to look citizens in the eye, given this deal, and raise council tax more than necessary.

“And I’m sure those discussions will lead to a sensible outcome.”

Funding for local authorities will exceed £15 billion for the first time under the Government’s budget plans.

Robison said this would include £289 million of non-ring fenced discretionary funding in general revenue grants.

That record deal would still be less than the £15.4bn sought by Cosla ahead of the budget.

A recent survey The Local Government Information Unit found that almost a fifth of councils were considering a tax increase of at least 10% next year.

Perth and Kinross councilors have already voted in favor of the proposals, which would see tax increases of 10% in 2025 and 2026 and 6% in 2027.

The scheme will be subject to approval when the local authority agrees its budget in February.

Since 2007, council tax has generally either been frozen or capped at increases by Holyrood.

according to Figures for 2021-22Council tax revenue accounted for approximately one fifth of local authority funding.

Levy banned in 2024-25The government pays councils more than £200 million to cover the costs.

The freeze was welcome news for home owners, but it left councils fuming with cash shortages.

With rates based on property values since 1991, the move has also been criticized as an ineffective way of helping the worst off.

After the budget, Kosla said she would “analyze the impacts on local authorities in the coming days”.

Scotland’s 32 councils will spend the coming days trying to find out what the budget really means for them.

Some of that money will be earmarked or tied to special purposes or projects.

Councils have a legal responsibility to set a balanced budget.

Council tax makes up a relatively small amount of each council’s total budget but is extremely important as it is paid by every household.

But would a significant increase be acceptable to local voters? Will they be unhappy with the bill increasing? Or would they be happy to pay more if they felt local services were being protected?

In 2023, with inflation at its peak, councils have the freedom to raise council tax as much as they see fit. Many went for a 5% increase, although some went for more.

Individual councils will decide on local council tax increases in approximately two months’ time.

The Scottish Conservatives said the government should have used the budget to reverse “damaging tax rises”.

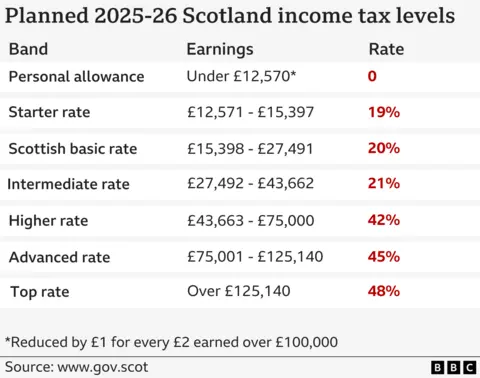

Robison instead proposed a change to the lower income tax threshold, which he said would provide “certainty and stability” for taxpayers.

According to the Chartered Institute of Taxation, the move will save people earning less than £30,300 a year up to £28.27 compared to people living elsewhere in the UK.

Robison said the income tax measures set out in this budget would raise an additional £1.7 billion for the Scottish Government compared to the UK system.

Another major announcement was an additional £2 billion in cash terms for the health and social care budget over 2024–25.

However, David Phillips, associate director of the IFS, said Figures published with Robison’s speech Suggestions are that the actual raise will be closer to £1 billion.

A proposal to effectively scrap the two-child limit on benefits in Scotland was “rabbited out” in the SNP budget.

UK government policy prevents parents from claiming Universal Credit or Child Tax Credit for a third child, with some exemptions.

Robison said she aimed to provide funding to 15,000 families of affected children in Scotland by April 2026 – but did not explain how the government would achieve this.

The government estimates it will cost between £110m and £150m in 2026–27. Independent economists call cost This could rise to £300m in future years.

SNP ministers say Social Security Scotland will get £3 million over the next two financial years to build the system needed to reduce the cap, but they need the UK Government to provide data on who will lose benefits because of the policy Is missing.

Robison said, “I would be surprised if the UK Labor government did not make sure that the Department for Work and Pensions is dealing with this in a sensible, productive way.”

getty images

getty imagesThe two-child limit was introduced by the Conservative UK government in 2017, but has been kept in place by Sir Keir Starmer’s Labor administration.

At First Minister’s Questions, John Swinney said his government wanted to end the “heinous” two-child limit “as Britain’s Labor government has failed to do to date”.

following a His six priorities were stated in the speechSir Keir said he did not accept that scrapping the cap would be a “silver bullet” to tackle child poverty.

“If you really want to tackle child poverty you have to focus on health, you have to focus on education, you have to focus on many aspects of a child’s life,” he said.

The Labor leader said he was committed to reducing child poverty and has done so set up a task force making it happen.

pa media

pa mediaIn each of the last three years, the Scottish Government has been forced to use emergency powers to balance its budget. announcement of £500m cut Earlier this year, it cited public sector pay deals being 3% higher than anticipated.

For 2025–26, the government has again budgeted 3% growth, although this is part of a 9% growth over three years.

Robison insisted the government would not have to use emergency measures next year.

She also said that she would not “compromise” for £300m compensation package reported From the UK Government to offset the increase in employers’ National Insurance payments.

Holyrood ministers say UK-wide tax changes could increase the cost of public sector workers by more than £500m.

‘Disastrous’ budget

A UK Government spokesman said the Chancellor’s autumn budget committed more money to Scottish public services than ever before.

At First Minister’s Questions, Scottish Conservative leader Russell Findlay described the SNP budget as “disastrous”.

He said: “Instead of reducing taxes the SNP has dragged more Scots into paying higher income tax.”

Scottish Labor leader Anas Sarwar accused SNP ministers of “missing the opportunity” to secure record levels of funding from the UK Government.

He said he had “no plan, no leadership and no vision for Scotland”.