Credit Card, Savings and Horticult

Business correspondent

BBC

BBCBank of England on Thursday cut interest rates from 4.75% to 4.5%, the lowest level for more than 18 months.

Low rates can reduce the cost of borrowing, but may also have low returns on savings.

The BBC spoke to the borrowers and saving how the rate cut would affect them.

‘Our mortgage can be £ 125 per month’

Becky and John Ball, both 40, live with their daughters, 12 -year -old Sophie and nine -year -old Emily and her dog Burty live in Selbi, North Yorkshire.

Becky works in finance and John is a truck driver.

They live in their home for 11 years, and their five -year fixed term mortgage ends in April.

Currently they pay an additional £ 125 per month, with payment from £ 460 to £ 585.

Becky hopes that the rate cut means “our rate that we have secured in minutes will go down so that we can jump at a better rate before April”.

“We have already discussed what we can cut to meet the extra cost.”

But John says that the decline in interest rates will also affect his savings. “It’s swings and round dizziness, you win with one, you lose with another. This is really difficult for everyone.”

‘I am reduced by £ 40 on my savings’

Craig Mountain in Yorkshire has about 35,000 pounds in savings in both savings accounts and premium bonds.

He says that when the rates were at their recent peak of 5.25%, he was earning 4.75% on his savings, so about 180 pounds per month.

He is now earning 4%, which is expected that he expects to fall by 3.75% once the latest cut, which is equal to about 140 pounds per month.

“I probably look at the extreme (today) to lose £ 40 per month,” he says.

“As an additional income from savings interest as a semi-retired 55-year-old, additional income allowed me and my wife to live instead of just surviving.”

‘My mortgage can go up to £ 1,000 – we need to cut higher rates’

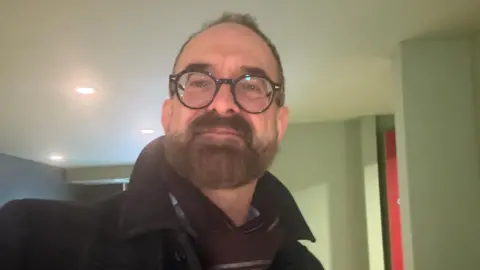

Stop count

Stop count59 -year -old Gino Rocco, and his partner Robert, have a five -year fixed rate hostage that ends in August.

They currently pay more than 2,000 pounds per month on their newbild flat at London Bridge. It can go up to £ 1,000 depending on the deal they manage the land.

He welcomes the cuts in interest rates, and hopes that when he is prepared for renovation, they continue downwards.

But he knows that they will still face a significant growth.

“We have to make changes. I know it will be very bad for others,” Gino says, who works as an in-house soliciter.

He says that his service fee, heating and water bills have also increased.

“It was comfortable, but as everything else grows, it is now about inexpensive.

“This is not just low -income people who are struggling.”

‘Interest rate on my credit card is 23% – 0.25% deduction is not enough’

Sequence

SequenceThe 48 -year -old Sabbu lives in a dorset with his wife and children.

When the interest rate on his mortgage increased from 2.1% to 5%, his monthly repayment increased £ 1,000.

Their current mortgage is for renewal in 2028, so he is now using a credit card to pay for increased costs. The interest rate on their credit card is 23%.

They say that the rates are not enough cut by a quarter percent.

“This is really difficult at this time, I think any additional cash goes to our basic living needs and we are not really too much left at the end of the month.”

Sabbu is talking to a broker to issue some equity from home to pay with his credit card. This may mean high repayment on hostage, but they think it can be a better solution as it is paid longer than a credit card.

“It’s very stressful, I don’t know how other people manage. I hope the rates are very low until we start again.”