Roman Abramovich UK could give £ 1bn on tax dodge which helped Bancolrol Chelsea FC

BBC News and File on 4 Investigation

BBC

BBCRussian Oligarch Roman Abramovich may be approved after a bottled effort to avoid tax on hedge fund investment, the evidence seen by the BBC said after an attempt to avoid taxes on hedge funds.

The leaked papers suggest that the investment of $ 6BN (£ 4.7bn) was rooted through companies in the British Virgin Islands (BVI). But evidence suggests that they were managed from the UK, so there should have been tax.

Some money funding Chelsea FC was owned by Mr. Abramovich, it could be detected back to companies involved in the scheme, BBC and Bureau of Investigative Journalism (TBIJ).

Oligarch lawyers said that he “always acted as an independent expert professional and got legal advice” and “worked according to that advice”. He refuses to be personally responsible for any knowledge or for any unpaid tax.

Powell, a labor MP who leads a parliamentary group on fair taxation, asked HM revenue and customs to “immediately”, to investigate the case that “very important amount of money can be there Which can be invested in public services “.

At the center of the scheme, Chelsea was a former director of FC and a billionaire businessman Eugene Shividaller, who is currently challenging the UK government’s decision to approve him for a close link to Mr. Abramovich.

Mr. Shividaller moved to the USA after Russia’s invasion of Ukraine, but from 2004 to 2022 he lived in the UK, with properties in London and Surrey.

A tax expert told the BBC that Mr. Schwideler was taking strategic decisions on the investment located in the UK, and not in the BVI, there was a “a very big smoking gun”, suggesting that companies should have paid UK tax .

The lawyers of Mr. Shividler stated that the BBC was reporting on “introduced the incomplete picture on confidential business documents” and made a strong and wrong conclusion as “Sri Schwidler’s conduct”.

He said that “the structure of investment” was the subject of the scheme very careful and detailed, which was initiated and advised by major tax advisors “.

The scheme, which includes Mr. Abramovich’s hedge fund investment, revealed in a huge leak of data that the BBC and the Bureau of Investigative Journalism have been investigating for more than a year – a Cyprus -a Cyprus – thousands of files and emails from the company Shri Abramovich adminors the global empire.

Getty images

Getty imagesBBC and its media partners, including The Guardian, are reporting on leaked files from 2023, as part of the International Union of investigative journalists’. Cyprus confidantial Investigation. On Tuesday, we revealed how Mr. Abramovich had Dodged millions in VAT at the ongoing cost of his boat fleet,

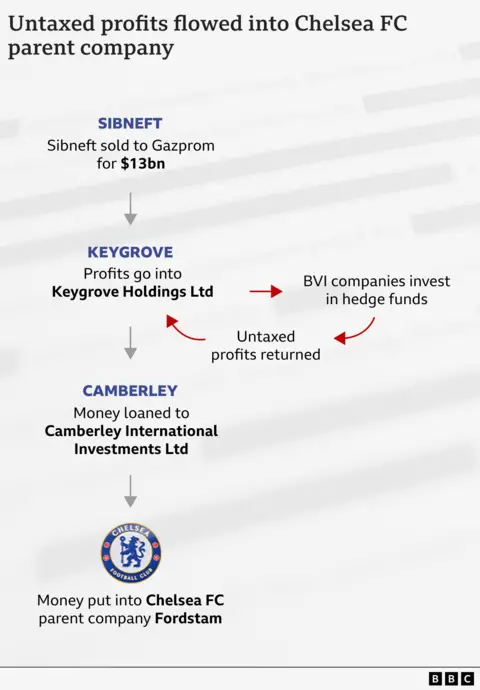

Leaked data shows how Mr. Abramovich had invested a large part of the money received in the 1990s A corrupt deal – Including it to a company in BVI Keygrove Holdings Ltd.

A network of Kigrov -owned British Virgin Islands companies invested this money – in the late 1990s and early 2020 – in the Western hedge Fund, in the Western Hedge Fund, up to $ 6BN (£ 4.8bn), according to leaked files .

These investments made an estimated $ 3.8BN (£ 3.1bn) in profits in about two decades. By investing through companies in BVI, which does not tax on corporate profits, it has been established to ensure as possible as possible.

‘Full strength to do anything’

It is not uncommon for businesses to legally invest from companies in taxes and pay tax on their profits. But the companies involved in this should be managed and controlled outstanding where they are included.

If the strategic decisions of an offshore company are being taken by someone in the UK, its profits can be taxed as it was a UK company.

The leaked documents show how the directors of BVI investment companies handed over wide powers to Mr. Shividoler who were living in the UK and received British citizenship in 2010.

The BBC has seen the “General Power of Attorney” documents dated between 2004 and 2008, which gave them “comprehensive possible powers” and “full power and full power to do anything” to investment companies in BVI.

Since 2008, Mr. Shividoler has gained the power to direct the investment of Kagrove, owned by BVI companies through another company.

The Millennium Capital Ventures Limited, who was owned by Mr. Shividler’s wife indirectly appointed and appointed as a director in 2000, became the investment manager of Kagrove. It was assigned “the entire power and the authority” to oversee and direct the investment of assets, “without prior consultation with the customer without all.

‘Strong evidence’

Regarding the important role of Mr. Shividler in investment decisions of BVI companies, in September 2023, the US Securities and Exchange Commission (SEC) led to a court case against a New York firm, which was revealed in a court case called a firm called Concord Management Was said.

The SEC filing says that the Concord had only one customer, as Mr. Abramovich was identified. The company recommended investment decisions for Oligark’s BVI companies.

It identifies a “long close aide” of Mr. Abramovich, called “Person B”, who made “investment decisions” for Mr. Abramovich.

It states that he was the point of contact to get investment advice “and” to make decisions or decide whether to proceed with recommended transactions “.

Using leaked documents, the BBC was able to identify “person B” as a eugene pruxury.

Evidence suggests that Shri Schwideler was taking decisions described by SEC to manage and control the investments of Mr. Abramovich from UK instead of BVI.

Getty images

Getty imagesTax expert Rita de Le Feria told the BBC that proof of a British resident, such as Mr. Shividoler, was taking “strategic big decisions” on hedge fund investment, a “clear sign” was that the UK taxed huge profits. Should have gone.

“I think this is a very big smoking gun. It again, it would be a strong evidence that the company was not effectively management in BVI,” he said.

The lawyers of Mr. Schwideler said that “there may be no question of Mr. Shividler, either intentionally or carelessly, is joining an illegal plan to avoid paying tax”.

The lawyers of Mr. Abramovich said that apart from the advice received on their tax matters, they hope that they were “sought a similar advice” with the responsibility of running the companies related to them “.

The leaked documents also show how the hedge funds of Mr. Abramovich passed a large amount of Hedge Fund Investments of Mr. Abramovich’s hedge fund investments before the Chelsea FC.

Hedge Fund Investment BVI returned to his companies and then Kigrov, returned to his original company.

Keygrowve then gave money to other companies in Mr. Abramovich’s network, which in turn to Camberley International Investments LTD to Money – Bancharll Chelsea FC.

By 2021, when Chelsea won the Champions League, Club World Cup and UEFA Super Cup, the club can detect millions of dollars in debt.

How did we calculate the bill

If HMRC was to be examined, how much can Mr. Abramovich or the concerned companies give?

We have assessed the profits made by investment companies in BVI from 1999 to 2018.

Leaked documents only contain full accounts for companies investing in hedge funds from 2013 to 2018.

But we can guess how much money the companies involved got in the entire period after seeing their “revenue reserves”. These are profits placed in businesses rather than paying shareholders. By the end of 2018 it was $ 3.8bn.

Historical UK Corporation tax and currency conversion rates are implemented in revenue reserves by 2012, and annual advantage for 2018, the amount for a possible tax bill of more than £ 500m for HMRC.

Getty images

Getty imagesBut in the event of unpaid tax check, HMRC may also impose late payment interest and punishment for failure to inform officers.

If the tax has become unpaid, it depends on whether an investigation concluded that those responsible people knew, but they did not tell HMRC, or did they not know, the total amount was about £ 700m to about £ 700m Can exceed £ 1bn.

There is a possibility that something can not be recovered by tax on profits, as HMRC probe can return only from a maximum of 20 years.

However, our calculation is also likely to be a lower, as we have implemented the lowest rate of corporation tax between 1999 and 2012, and it is possible that the profits were withdrawn from companies in the period which we did not include in ourselves. Sums is done.

In any incident, Mr. Abramovich’s tax bill can be dwarf £ 653m bill Formula One Boss Boss Paunted on Burney Ecleton In 2023.

Shutdians

After Russia’s full -scale invasion in Ukraine, the British government allowed Roman Abramovich to sell Tod Bohli to Chelsea FC. This did this on the condition that £ 2.5bn from income would be donated to the charitables supporting the victims of war in Ukraine.

Nearly three years later, the money still sits in a frozen Barclay bank account, allegedly due to disagreement on how it should be spent, want to go to the “all victims” of the war with Mr. Abramovich, And the UK government stressed and said that it should be spent only on human aid in Ukraine.

The BBC investigation shows that, as Ukrainians are waiting for money from former Chelsea Boss, they are the British taxpayers.

Cyprus confidantial The International Associate Investigation has been launched in 2023, headed by the International Consortium of Investigative Journalists (ICIJ), provided corporate and financial services to colleagues of Russian President Vladimir Putin in Cyprus firms.

Media partners include Guardian, Investigative News Room Paper Trail Media, Italian newspaper L’ESPRESSO, The Organized Crime and Corruption Reporting Project (OCCRP) and the Bureau of Investigative Journalism (TBIJ).

TBIJ Reporting Team: Simon Lock and Ellenor Rose.